Low and no ABV beverages are shaping Western Europe spirits sector

As trends towards health and wellness continue to mount, producers in Western Europe are expanding their portfolios with low and no ABV products.

Led by the beer and cider sector in 2010s, the 2020s will be the decade of ‘NoLo’ spirits. Between 2020–2024, low ABV products in the Western Europe Spirits sector will rise at a compound annual growth rate (CAGR) of 2.6%*1, writes GlobalData, a leading data and analytics company.

Holly Inglis, Beverages Analyst at GlobalData, comments: “After what was a tumultuous 2020, consumers are more determined than ever to maintain a healthy, moderate lifestyle that promotes balance, both physically and emotionally. Starting this was of course ‘Dry January’.”

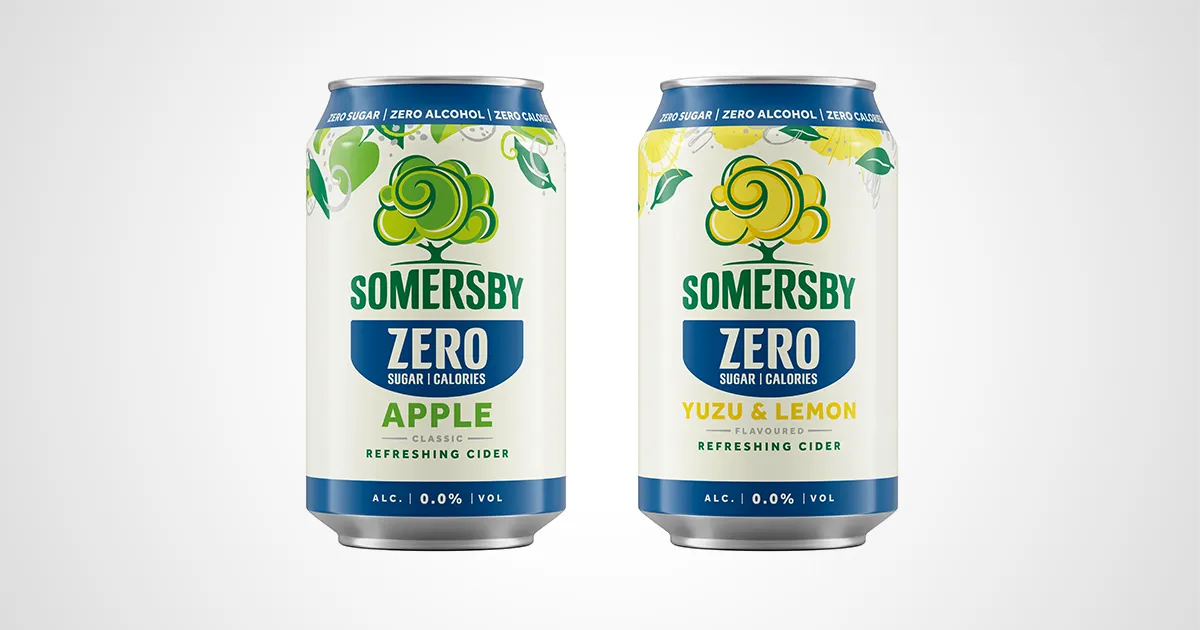

The low ABV trend was first championed by the beer and cider sector. According to GlobalData’s research, between 2015 and 2020, innovations in beer and cider products with an ABV equal to and below 0.5% grew by 8.4% and 9.3%, respectively, across Western Europe*2, and these developments will help illustrate what is next for spirits.

In fact, spirit producers are raising the bar, with Pernod Ricard announcing release of its 20% ABV ‘light’ Beefeater Gin and Martini & Rossi S.p.a introducing a ‘Floreale’, non-alcoholic vermouth of the original Martini brand.

Inglis continues: “Mental health is a rising concern within the consumer sphere, which has gained particular focus in light of the COVID-19 pandemic. In August 2020, Folklore Distillery released a limited-edition charity bottle to support mental health charities, MIND Foundation and Blurt Foundation, a timely release when much of the UK was struggling after the effects of the first national lockdown.”

Beer brands have leveraged the ‘healthier’ and ‘more responsible’ position of their low ABV offerings to promote mental health awareness – a road spirits producers are likely to follow. Bristol Beer Factory also launched non-alcoholic beer, Clear Head, in partnership with mental support network, Talk Club. This launch also follows Heineken’s replacement of Amstel with Heineken 0.0% to sponsor the UEFA Europa League in 2020. This initiative coupled with continued NoLo launches reinforces manufacturers’ social commitment to supporting the consumption of alcohol in moderation.

In terms of consumer appeal, GlobalData’s 2019 consumer survey indicated that over half (54%) of European respondents find “alcoholic drinks with low or no alcohol” somewhat or very appealing*3.

Inglis adds: “Consumers remain extremely experimental, with premium innovations driving this trend. NoLo alcohol spirits naturally have a premium positioning, with a ‘natural halo’ offering the consumer a sophisticated drinking experience, and volume is expected to reach 0.12 million litres by 2024*1”.

*1 GlobalData’s Wine & Spirits Market Analyser – Market Data – Spirits Alcoholic Strength Volume with 5-year Category Forecast

*2 GlobalData’s Beer & Cider Market Analyser – Brand Volume and Value

*3 GlobalData 2019 Q4 Consumer Survey Results Europe

Source: GlobalData

Photo: ©iStockphoto | VadimZakirov